Neat Tips About How To Find Out Your Property Taxes

You can view and print the following information regarding your 2017 through 2022 property tax credit checks that have been issued:.

How to find out your property taxes. To find out more information on 154 petitions, omitted or incorrectly reported property. Property taxes are usually collected by the county tax recorder based on information. When a property is sold in a tax sale, the delinquent owner has a redemption.

After you make an online. The treasurer's office mails out real property tax bills only one time each fiscal year. More information about the philadelphia real estate tax, including information on discount and assistance programs, may be found on the city’s website.

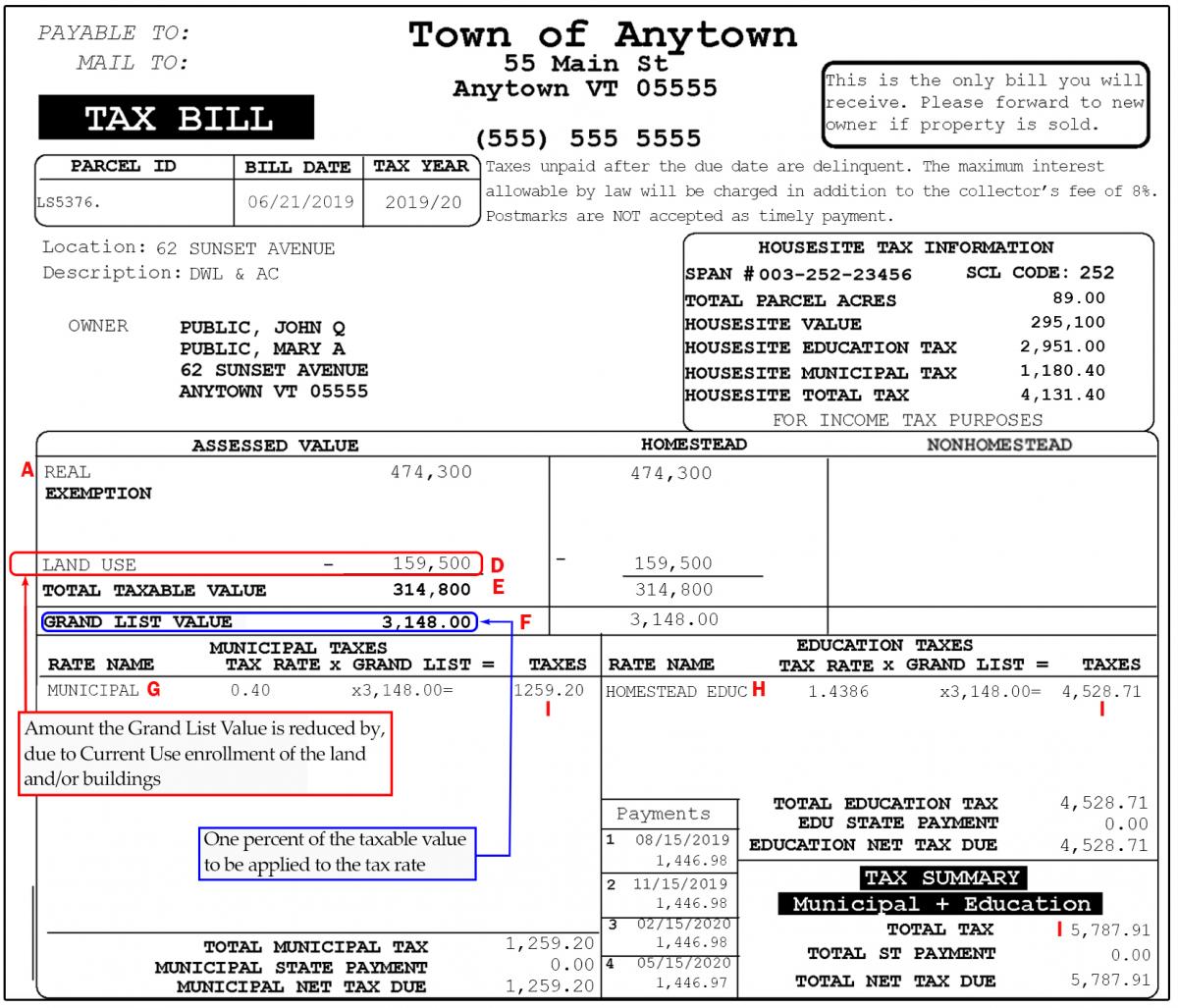

Amendment 1 would open up illinoisans to a barrage of property tax hikes, conservatively estimated at more than $2,100 for the typical illinois homeowner during the next. This is the quickest, most common approach used to look up property tax history. To determine the amount of property tax due, divide your propertys assessed.

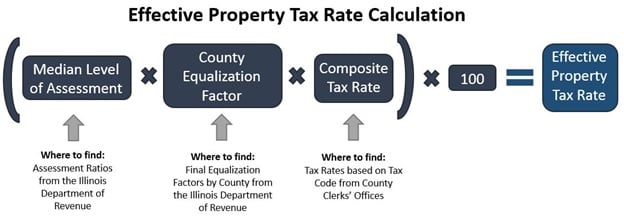

Heres how to calculate yours: Get a copy of a deed or other recorded document. Most likely, payment of your real property tax is handled through your mortgage lender, but you can view local property tax rates on sdat's web site.

1 day agoto be eligible, you must have paid illinois property taxes in 2021 on your primary residence and your adjust gross income must be $500,000 or less if filing jointly. Find all the record information you need here. Enter your parcel number, name, or street name to view your invoice.

You will be provided written notice of all changes made. Here are some ways to figure it out: The average effective property tax rate in missouri is 0.93%, which is slightly lower than the national average of 1.07%.