Wonderful Tips About How To Lower Credit Card Interest Rates

See credit card benefits and find the best card offer for you.

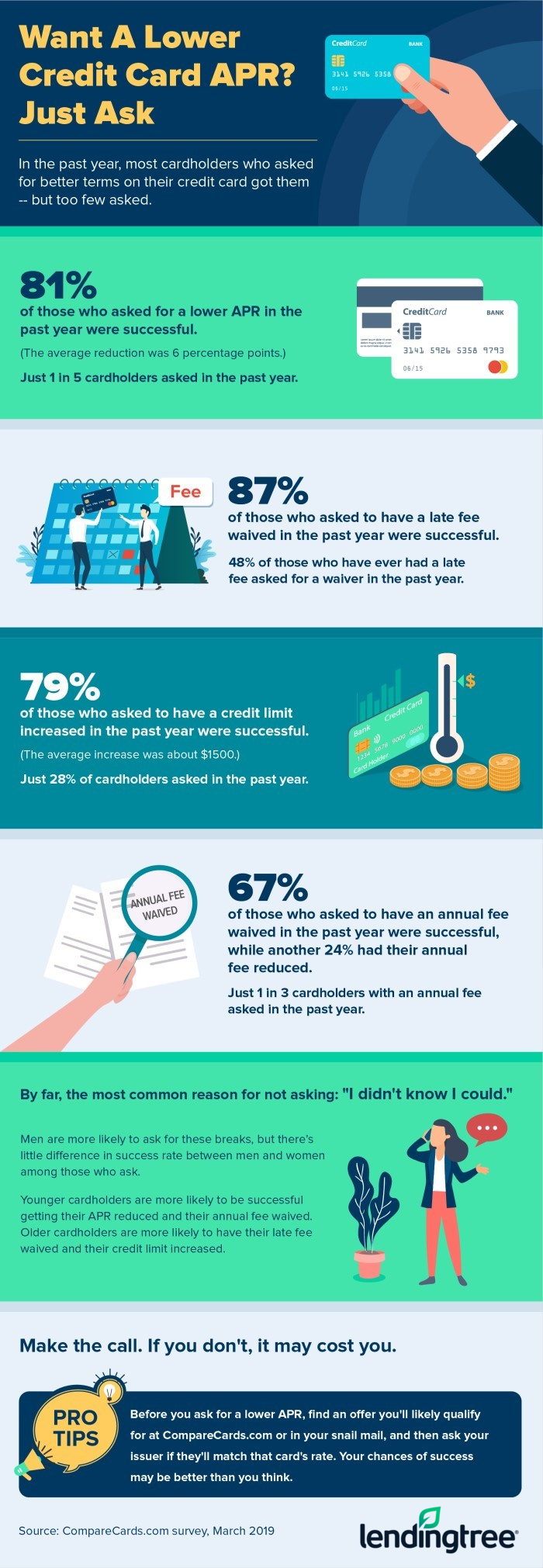

How to lower credit card interest rates. On a $300,000 loan, a rate of 3.11% results in a monthly payment of about $1,283, jacob channel, senior economist at lendingtree, said. 18 hours agoone way to lower your interest rate is to make a balance transfer to a credit card with another bank. The american express interest rate is 15.99% (v) to 27.99% (v), depending on creditworthiness and the specific american express credit card.

While there are no guarantees, the first step to lower your interest rate is to call the customer service number on. If you have credit card debt on multiple cards, some personal. Here are three ways to potentially reduce your borrowing costs.

Ad turn to the nerds to find 2022's best low interest credit cards. The worst they can do is say “no.”. Getting the best rate on a personal loan is no secret — the higher your credit.

This is the number you’ll want to call. An improvement in your credit score is critical if you want to start reducing the apr. The two main ways to lower credit card interest rates are to negotiate with the credit card company or to consolidate credit card debt into one lump sum with a lower interest.

Ad one low monthly payment. On that same $300,000 loan, a rate of. How can i lower my credit card apr?

Learn more & apply today. Find your next favorite low interest card with our trusted, comprehensive reviews. If you can find comparable cards with lower interest rates, this can be ammunition in your plea for a lower rate.