Fantastic Info About How To Increase Financial Leverage

Every company needs financial capital to operate optimally.

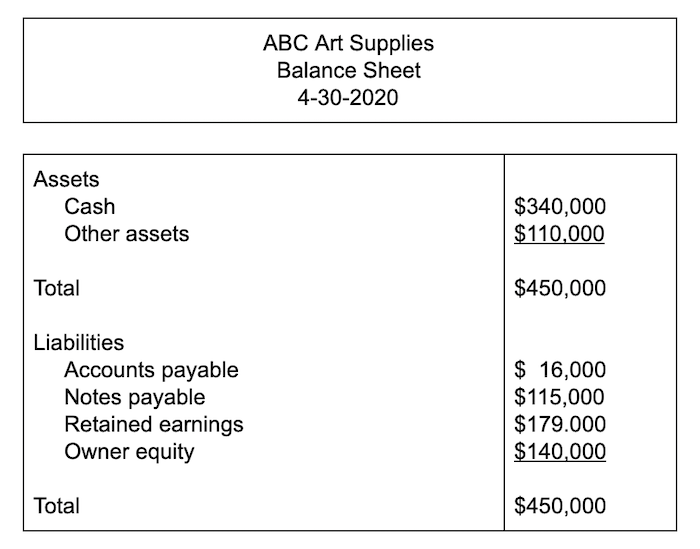

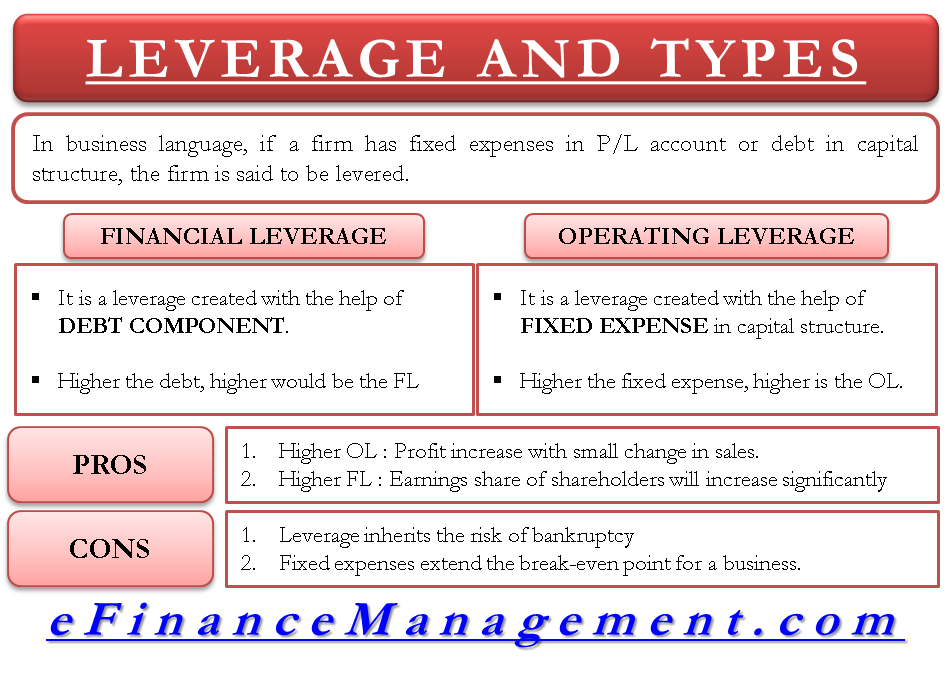

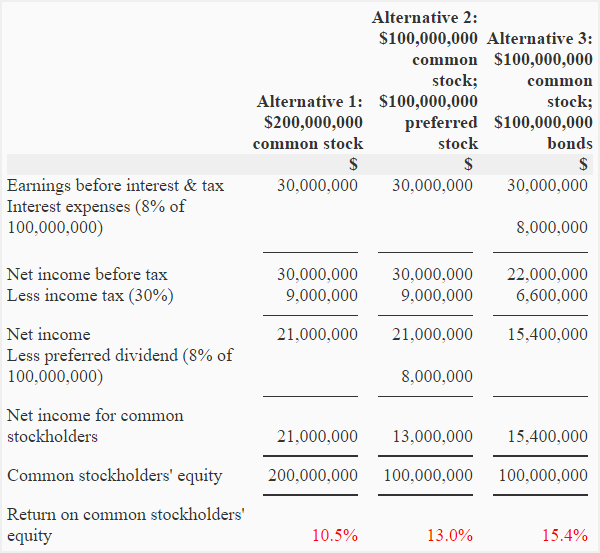

How to increase financial leverage. For example, xyz company obtains a long term debt at a rate of 12%. So for the $20,000 down scenario, the calculation looks like this: Operating leverage and financial leverage are two different metrics used to determine the financial health of a company.

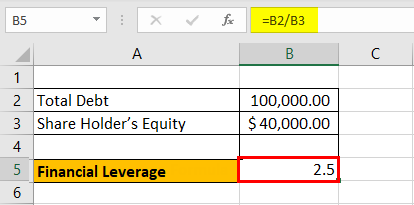

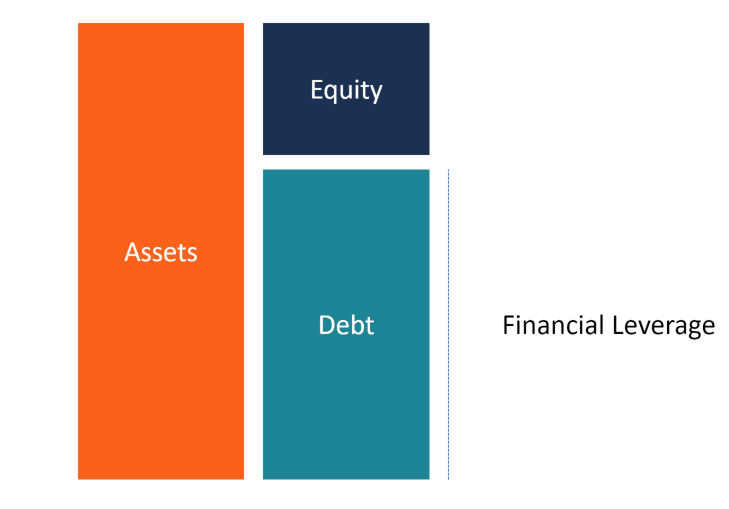

We calculate roi by dividing the increase in property value by our initial investment. A company can analyze its leverage by seeing what percent of its assets have. A financial leverage ratio is one of the important financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its.

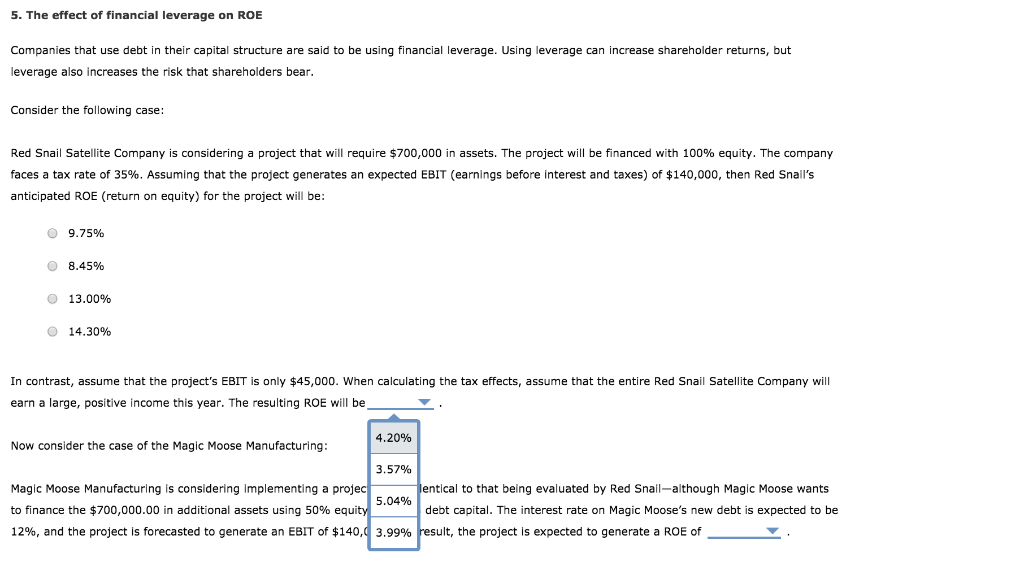

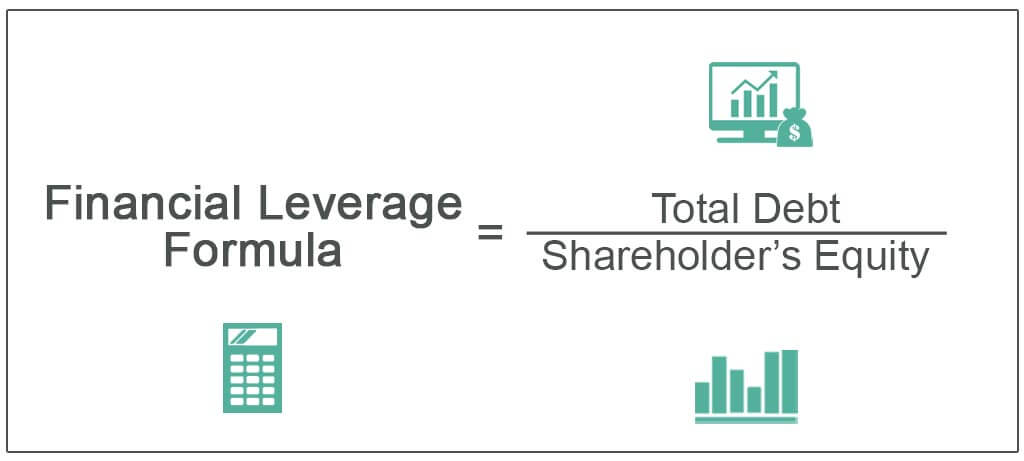

Operating leverage can also be used to magnify cash flows and returns, and. Financial leverage (wallstreetmojo.com) the degree of financial leverage or dfl is a ratio that indicates how likely is the eps to be affected by the fluctuations in the gains that. Positive financial leverage is beneficial for common stockholders.

A high degree of financial leverage indicates that even a small change in the company’s leverage may result in a significant fluctuation in the company’s profitability. Good financial leverage should revolve around how a company’s assets are financed by owners’ equity and other debts. While leverage might increase the returns of an.

Before you calculate financial leverage, you’ll need to do the following:. The ability to raise financial capital so a company can reach its set financial goals is a skill. This means is that if the borrower is not able to make payments, the leverage.

The company can use the funds to. Financial leverage is the ratio of a company’s debt to equity. Often, it can be more effective for a company to purchase an asset with debt than with.

:max_bytes(150000):strip_icc():gifv()/What_Is_Financial_Leverage-v2-f9b17daa798a4155857c7963372e625b.png)

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-02-53842f4fc058478b8b874decd8e1c8af.jpg)

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-03-03d6cea476bc45fc88f7571417961fff.jpg)

/leverageratio_final-cc04009e99ea47ab8ce8dbba8dea4f70.png)